Life Insurance in and around Paducah

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

Protect Those You Love Most

Do you know what funerals cost these days? Most people aren't aware that the midpoint for the cost of a funeral in this day and age is $8,500. That’s a heavy burden to carry when they are grieving a loss. If those closest to you cannot manage that expense, they may experience financial hardship in the wake of your passing. With a life insurance policy from State Farm, your family can survive, even without your income. Whether it maintains a current standard of living, pays for college or keeps paying for your home, the life insurance you choose can be there when it’s needed most by your loved ones.

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Wondering If You're Too Young For Life Insurance?

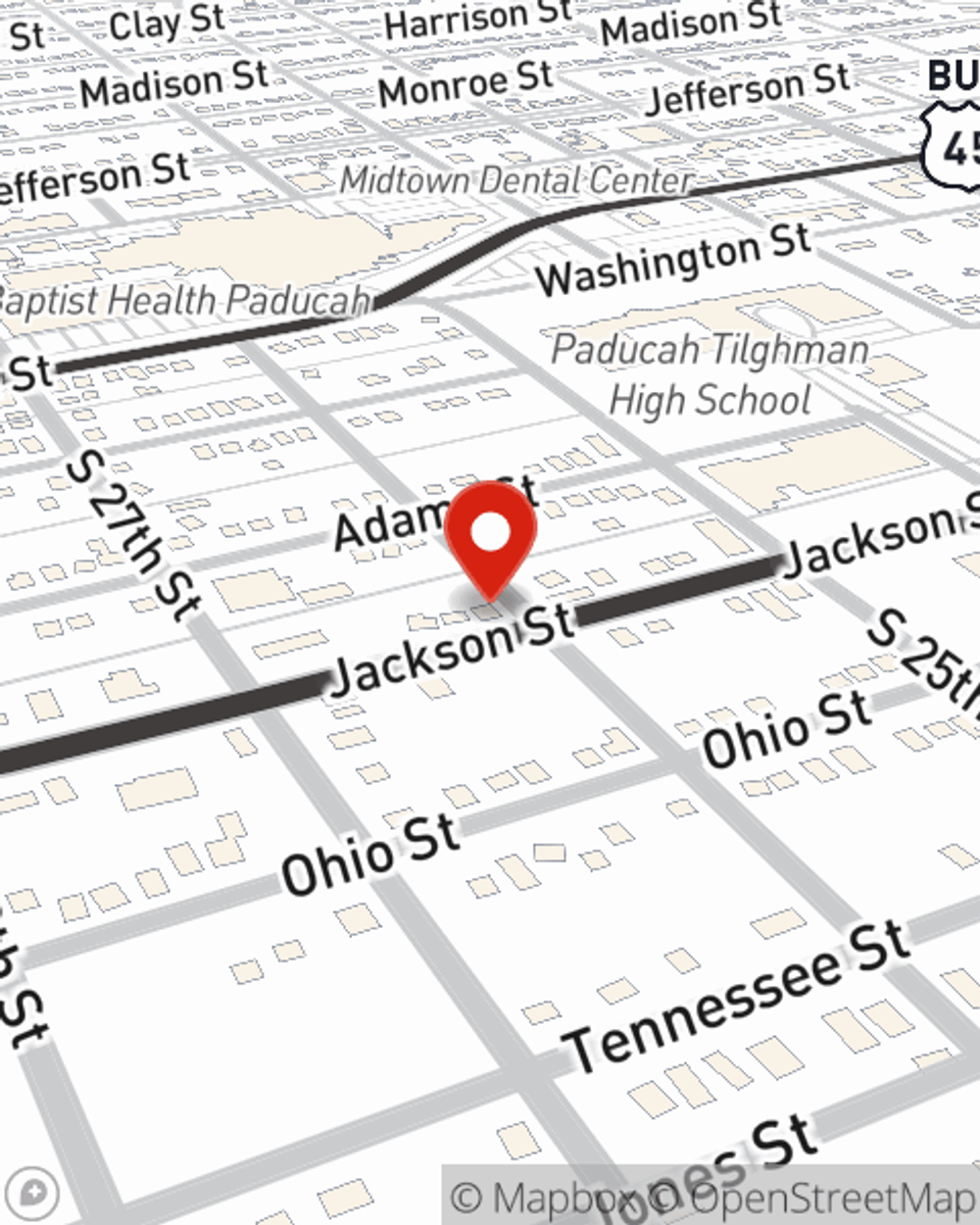

And State Farm Agent Adam Ford is ready to help design a policy to meet you specific needs, whether you want level or flexible payments with coverage designed to last a lifetime or coverage for a specific number of years. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

Interested in learning more about what State Farm can do for you? Contact agent Adam Ford today to get to know your individual Life insurance options.

Have More Questions About Life Insurance?

Call Adam at (270) 442-1123 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.